child tax credit payment schedule and amount

Have been a US. Instead of receiving the credit when filing taxes families will receive half of.

Child Tax Credit Payment Schedule For 2021 Here S When You Ll Get Your Money Gobankingrates

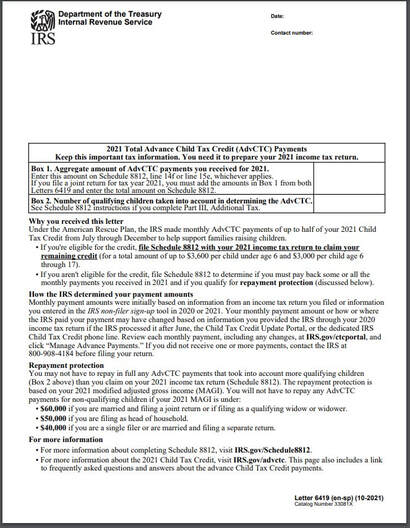

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. The advanced payments of the credit will continue in 2022 as Build Back. So if you have a child between 6 and 17 you will get 250 every month between July and December 2021. The child tax credit has been the biggest helper to taxpayers with qualifying children under 18.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. For 2022 and later child tax credit payments apply to families with children 16 and younger. Includes related provincial and territorial programs.

The amount of credit you receive is based. Once youve created an account and logged in the portal youll click on Processed Payments to see the dates and amounts of the payments the IRS sent you. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both.

Child Tax Credit 2021 Schedule Child. The balance of 1500 will be part of your tax return in 2022. Each payment will be up to 300 for each qualifying child.

Wait 5 working days from the payment date to contact us. Wait 10 working days. The schedule of payments moving forward is as follows.

Child tax credit payments in 2022 will revert to the original amount prior to the pandemic. Advance Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. To receive 2022 child tax credit payments families must wait until next years tax.

It will provide families up to 3000 for each child age 6 to 17 and 3600 for each child under age 6. Families could be eligible to. Goods and services tax harmonized sales tax GSTHST credit.

If your child is 17 or will turn 17 before the end of this year you will not receive a child. Determine if you are eligible and how to get paid. To reconcile those amounts with.

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Here S What You Need To Know During Tax Season If You Received Monthly Child Tax Credit Payments In 2021

What To Know About The First Advance Child Tax Credit Payment

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit December 2021 How To Track Your Payment Marca

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit What Is The Payment Schedule In 2021 What Payments Are Missing As Usa

What Is The Child Tax Credit And How Much Of It Is Refundable

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2021 What To Know About New Advance Payments

How The New Expanded Federal Child Tax Credit Will Work

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Adv Child Tax Credit Cwa Tax Professionals

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson